Referral Partners ERC Resource Center

Need Help? Click Below

ERC Filing Deadlines

An eligible employer claiming a refundable credit for any quarter in 2020 must file its 941x forms by April 15, 2024.

An eligible employer claiming a refundable credit for any quarter in 2021 must file its 941x forms by April 15, 2025.

Marketing & Essential Forms

E-Mail Templates & Signature

Hi [Prospect],

I’m reaching out to share a unique opportunity for your business. It is a government program called the Employee Retention Credit or ERC. The ERC is a refundable payroll tax credit for eligible employers who experienced difficulties due to the COVID-19 pandemic from March 13, 2020 to September 30, 2021.

The program has significant benefits for those businesses that qualify with direct payments of up to $26,000 per W2 employee. Qualification is complex and we provide white glove service to guide you through the process.

Your business can qualify with a decline in revenue or a full/partial suspension of business operations due to governmental orders appropriate governmental orders enacted in response to the COVID-19 pandemic.

Below please find some material to educate you on the program. Please click here (insert personal marketing link) to schedule time with our team to answer any of your questions and guide you through the process.

We look forward to connecting with you.

[Name] : [Company Name, if applicable] : [Phone Number]: [eMail Address]

A member of the Bottom Line Referral Network

BLC Academy Links: BLC Overview

What is ERC? | Two Ways to Qualify | FTE Limitations | Income Tax Requirements | Interaction with PPP

Has your business filed for the Employee Retention Credit yet?

The ERC is a refundable payroll tax credit for eligible employers who experienced difficulties due to the COVID-19 pandemic from March 13, 2020 to September 30, 2021.

There’s a common misunderstanding that only businesses who had a decline in revenue are eligible, this is not the case. There are other ways to qualify. Your businesses unique “facts and circumstances” determine eligibility. And your business may still qualify even if you increased revenue, received a PPP loan, or hired more employees.

Below please find some material to educate you on the program. Please click here (insert personal marketing link) to schedule time with our team to answer any of your questions and guide you through the process.

We look forward to connecting with you.

[Name] : [Company Name, if applicable] : [Phone Number]: [eMail Address]

A member of the Bottom Line Referral Network

BLC Academy Links: BLC Overview

What is ERC? | Two Ways to Qualify | FTE Limitations | Income Tax Requirements | Interaction with PPP

[Name] : [Company Name, if applicable] : [Phone Number]: [eMail Address]

A member of the Bottom Line Referral Network

BLC Academy Links: BLC Overview

What is ERC? | Two Ways to Qualify | FTE Limitations | Income Tax Requirements | Interaction with PPP

BLC Academy

Related Links

IRS ERC Guidelines

Referral Partner Center

ERC qualification is a complex and nuanced process and can vary based on State, industry, governmental orders etc… Most Accountants are well versed in the accounting procedures and the tax code and I’m sure yours is the same.

However, the ERC is a specialized program and one that requires an in-depth understanding of the nuances I mentioned. Our team is comprised of in-house tax attorneys and CPAs that specialize in government programs and the ERC.

The ERC program has two ways to qualify:

- A significant decline in gross receipts for any eligible quarter in 2020 or 2021, defined as a 50% reduction in revenue during any quarter in 2020 compared to the same quarter in 2019, or a 20% reduction in revenue in any quarter of 2021 compared to the same quarter in 2019.

- A full or partial suspension of operations due to orders from the federal government, or a state government having jurisdiction over the employer, limiting commerce, travel, or group meetings related to COVID-19.

It is possible your accountant is not familiar with the qualification paths and nuances, and we are happy to share our experience and expertise. Our objective is to help your business if you feel you and your business meet the eligibility criteria.

Remember, we have been in business for over 15 years supporting organizations like yours across many government aids and cost saving programs. We help educate you on the program and walk you through the process with our white glove service. If you choose to not proceed with us we hope you will continue to clarify your eligibility and learn more about the ERC program and how it might benefit your business.

At Bottom Line, we are steadfast in our mission to educate American businesses on the ERC program and help them realize savings in a transparent, ethical, quality, and compliant manner… helping them reinvest in themselves and their future.

I understand you feel our fee is too high. If a customer believes they are eligible for ERC, we never want our fee to dissuade anyone from filing for ERC. That said, ERC qualification is a complex and nuanced process and can vary based on State, industry, governmental orders etc…

You should know that our company has been in the government aid and tax recovery business for over 15 years. Our team is comprised of in-house tax attorneys and CPAs that specialize in government programs and the ERC. We not only provide a white glove service to all customers, regardless of size, we also provide audit support should an audit arise. In the unlikely event of an audit, BLC has you covered. We provide audit support for all our customers. We also assume the risk with each client, forfeiting our fee if disallowed funds require repayment to the IRS.

We understand that we might not be the right fit for every customer and there are other companies out three that might be a better fit. If you choose to not process with us, we just ask that you do your research and visit the IRS website for watchouts on 3rd party companies. The IRS does a great job explaining some of those watchouts for “scammers”.

At Bottom Line, we are steadfast in our mission to educate American businesses on the ERC program and help them realize savings in a transparent, ethical, quality, and compliant manner… helping them reinvest in themselves and their

future.

That is a great question and an important point to review. The IRS audits claims as part of their normal course of business and the ERC program is no different. While the audit rate is low it is something that could occur.

If audited, Bottom Line Concepts has you covered. We provide audit support for all our customers. We also assume the risk with each client, forfeiting our fee if disallowed funds require repayment to the IRS.

You also need to understand the audit period: The IRS Audit period for ERC is: 3 years for 2020 and Q1,Q2 of 2021 and 5 years for Q3 of 2021

At Bottom Line we believe in ethical, conservative filings for the Employee Retention Credit (ERC) and following IRS guidelines. At Bottom Line Concepts we stand behind our work and offer audit support, documentation of eligibility determination and a summary of all calculations used to determine the refund.

If you are contacted by the IRS directly or through a letter, the first thing we ask you to do if reach out to us so we can

gameplan the best way to respond and begin our audit support for you.

Two Specific Ways to Qualify for ERC

1. Decline the gross revenue. Each quarter is independently measured against the comparable quarter in 2019

50% decline in 2020(Q2,3,4)

20% decline in 2021(Q1,2,3)

2. Full or partial suspension of operations

The second way to qualify is if your business experienced a full or partial suspension of operations. A partial suspension is defined by having to make modifications to the operations of a business due to government orders resulting in a “nominal effect” to the business operations.

“Nominal Effect” – IRS Notice 2021-20-Page 39 “The mere fact that an employer must make a modification to business operations due to a governmental order does not result in a partial suspension unless the modification has more than a nominal effect on the employer’s business operations. Whether a modification required by a government order has more than a nominal effect on the business operations is based on the facts and circumstances. A governmental order that results in a reduction in an employer’s ability to provide goods or services in the normal course of the employer’s business of not less than 10 percent will be deemed to have more than a nominal effect on the employer’s business operations.”

The considerations for determining the nominal effect are that you would be able to say yes to at least one of the bulleted items in the list of Covid.

On October 19th of 2022, the IRS issued a warning regarding the ERC program as it relates to some 3rd party processing firms. You can find a link to the warning on the IRS site here.

The IRS warning suggests some 3rd party processing firms charge large up-front fees or contingent fees without proper calculation methods or understanding of the ERC program which may result in repayments, penalties, and accrued interest, adversely impacting their business.

At BLC, we are aware of the IRS warning and are supportive of its mission to inform employers to do their diligence when selecting a 3rd party to assist with their ERC.

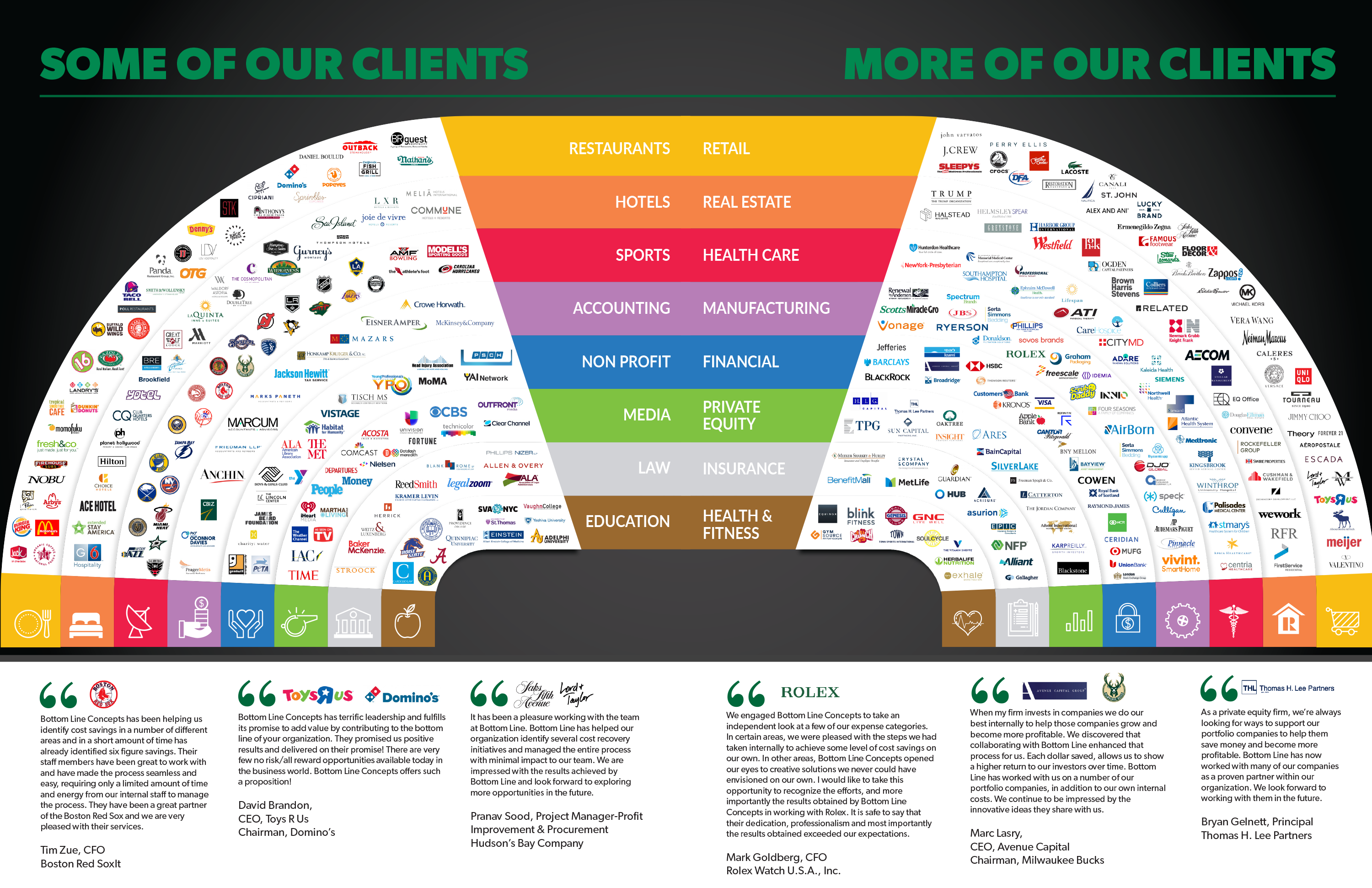

We have served clients across many industries and represent ~30% of the top 100 accounting firms, ~30% of the top 100 law firms and 20% for the Fortune 1000. I’d like to personally confirm our commitment to you and your organization.

Through our 15 years’ experience in recovering money from the federal and states governments, we strive to provide you with the best ERC service and experience in the industry. We pride ourselves on delivering cost savings and value to our clients. In all our years’ operating, we have never charged any upfront fees.

As part of our service, we commit to provide you with:

A comprehensive ERC Report that is an audit ready file based upon IRS audit guidance.

Guidance to help you understand the ERC Program and clearly explain both Your eligibility and how Your eligible wages are calculated, especially what ineligible wages must be excluded from your ERC claims.

Proven by our track record, we are confident in our approach, calculation method and quality process. Should you have any question on this matter please reach out to me directly.

We appreciate your business and trust in our ability!

On October 19, 2022, the IRS issued a warning on ERC claims. They renewed and expanded that warning yesterday on March 7, 2023. We at Bottom Line are very pleased that the IRS issued these warnings, as there are many fly-by-night, so-called ERC “experts” or “consultants” that are misrepresenting their experiences and the parameters of the ERC program to employers. As you know, Bottom Line is no newcomer, with over 14 years in the cost-savings consulting space. From the very beginning of the CARES Act we have made our clients aware of the ERC opportunity and assisted qualifying clients, many of which are part of the top 100 accounting and law firms and Fortune 1000, in navigating the ERC claims’ submissions process.

Many potential clients will be—and should be—aware of the IRS warnings. The IRS warns employers to carefully review the ERC guidelines before submitting a claim. There are several dubious promoters pushing ineligible employers to file while not informing employers that wage deductions claimed on their tax returns must be reduced by the amount of their ERC refund through amending their returns. The following addresses each of the IRS warnings and how these warnings relate to the services that Bottom Line provides its clients:

Bottom Line provides IRS qualification information to every client. For instance, we highlight that clients may qualify not only based upon a significant decline in gross receipts; they may also qualify if a client’s operations were fully or partially suspended in the event that gross receipts were not impacted.

At Bottom Line, we routinely assist clients with 5 or more W-2 employees navigate the ERC process, including performing calculations to determine the amount that each client qualifies for and assisting in the preparation of IRS filings.

For clients who have already filed their income tax returns for the applicable year receiving ERC, at Bottom Line, we highlight the need for them to amend their returns to correct any overstated wage deductions.

At Bottom Line we are very proud of the services we provide to our clients, which exceed the highest industry standards. We continue to monitor and update our team and clients with respect to any changes to IRS guidance as it relates to the ERC program.

As always, we thank you for your efforts on behalf of Bottom Line.

On March 20, 2023, the IRS published its annual “Dirty Dozen” list of a variety of scams that taxpayers may encounter, which includes aggressive ERC promoters making offers too good to be true. The IRS also cautioned taxpayers to be cognizant of advertisements which exist solely to collect the taxpayer’s personally identifiable information in exchange for false promises, warning that these scammers then use the information to conduct identity theft.

We at Bottom Line are very pleased that the IRS continues to issue these warnings to unsuspecting taxpayers, as there are several dubious promoters pushing ineligible employers to file while not informing employers of various aspects of the ERC program impacting their taxes. These fly-by-night, so-called “experts” that misrepresent the ERC program inevitably taint legitimate service providers and consultants who want to help qualified taxpayers to obtain legitimate employee retention credits, as the CARES Act intended. Reiterating several earlier alerts, the IRS highlights schemes from promoters that are based on inaccurate information related to eligibility for and computation of the credits.

As you are likely aware, Bottom Line is no newcomer, with over 14 years in the cost-savings consulting space. From the very beginning of the CARES Act we have made our clients aware of the ERC opportunity and assisted qualifying clients, many of which are part of the top 100 accounting and law firms and Fortune 1000, in navigating the ERC claims’ submissions process. We work closely with several former IRS tax attorneys to navigate the most up-to-date IRS guidance. The following addresses the IRS’s warnings and how these warnings relate to the services that Bottom Line provides its clients:

Bottom Line provides IRS qualification information to every client. For instance, we highlight that clients may qualify not only based upon a significant decline in gross receipts; they may also qualify if a client’s operations were fully or partially suspended as a result of government orders.

At Bottom Line, we routinely assist clients with 5 or more W-2 employees navigate the ERC process, including performing calculations to determine the amount that each client qualifies for and assisting in the preparation of IRS filings.

Obviously, when clients who have already filed their income tax returns for the applicable year receive ERC credits, we also highlight that such clients will need to amend their returns to correct any overstated wage deduction.

For clients who have already filed their income tax returns for the applicable year receiving ERC, at Bottom Line, we strive to make it clear, and highlight the need for them to amend their returns to correct any overstated wage deductions.

At Bottom Line, we continually monitor and update our team and clients with respect to any changes to IRS guidance as it relates to the ERC program. We are very proud of the services we provide to our clients and, as always, we are thankful for the trust you have placed in us to assist with your ERC needs.

This is sent as part of BLC’s continued updates of IRS alerts related to bad actors and abuses of the ERC program. In the most recent alert on May 25th, the agency appropriately reiterated its warning to businesses and tax-exempt groups regarding ERC scams that use deceptive marketing practices to encourage the filing of fraudulent claims—ERC claims that the targeted business does not qualify for.

The ERC is a critical program supporting American small business and aligned to the mission BLC has had for over 15 years: to help American business realize savings in a transparent, ethical, quality, and compliant manner. As a cost reduction consulting company that includes client assistance with the ERC program, BLC applauds the IRS’s proactive efforts to highlight risks for small businesses and warning the public of bad actors.

As we explain to clients, the IRS qualification and eligibility requirements are complex and require expertise, experience, and time. Should a client or RP ask about this IRS warning, please refer to the points below so we can help educate them while also ensuring that our market message remains consistent:

- We are aware of the IRS warning and are supportive of its mission to inform companies of the signs of potential bad actors.

- We agree that the application process is complex and requires expertise and experience to calculate the potential refund.

- The BLC screening process takes time and is underpinned by a detailed qualification analysis method to ensure compliance with the IRS guidelines.

- BLC was founded in 2009, and for all our years operating, we have never charged any upfront fees.

- We ensure our clients understand the ERC program and clearly explain both a Client’s eligibility and how their eligible wages are calculated—especially what ineligible wages must be excluded from their ERC claims.

- Roughly 40% of business referred for possible ERC filing were not accepted by Bottom Line for ERC filing assistance as our screening process determined that these businesses did not meet the ERC criteria as set forth in the Cares Act.

At Bottom Line, we are steadfast in our mission to educate American businesses on the ERC program and help them realize savings in a transparent, ethical, quality, and compliant manner… helping them reinvest in themselves and their future.

Frequently

Asked

Questions

Have questions? We are here to help.

No. Only W-2 employee wages can be claimed, and you cannot claim your own wages as a majority owner even if you are on a W-2 wage.

No. Only W-2 employee wages can be claimed for the credit.

Yes! You can apply for ERC, but you may not claim ERC on wages paid to family members of majority owners. This includes immediate family plus in-laws, aunts, uncles, and cousins.

Yes! Your business will be able to qualify for ERC if you had a full or partial suspension of operations.

The Employee Retention Credit (ERC) uses qualified wages as the basis for its calculation, which covers any wages paid that are subject to FICA taxes. These qualified wages can include various types of compensation, such as salaries, hourly wages, vacation pay, and certain health plan expenses, among others.

The program began on March 13th, 2020 and ends on September 30, 2021, for eligible employers. You can apply for refunds for 2020 and 2021 after December 31st of this year, into 2022 and 2023. And potentially beyond then too. We have clients who received refunds only, and others that, in addition to refunds, also qualified to continue receiving ERC in every payroll they process through December 31, 2021, at about 30% of their payroll cost. We have clients who have received refunds from $100,000 to $6 million.

Yes. Under the Consolidated Appropriations Act, businesses can now qualify for the ERC even if they already received a PPP loan. Note, though, that the ERC will only apply to wages not used for the PPP.

Your business qualifies for the ERC, if it falls under one of the following:

- A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meetings.

- Gross receipt reduction criteria is different for 2020 and 2021, but is measured against the current quarter as compared to 2019 pre-COVID amounts.

“To qualify for the ERC, an employer must meet one of the following requirements:

A significant decline in gross receipts for any eligible quarter in 2020 or 2021- defined as a 50% reduction in revenue during any quarter in 2020 compared to the same quarter in 2019, or a 20% reduction in revenue in any quarter of 2021 compared to the same quarter in 2019.

A full or partial suspension of operations – due to orders from the federal government, or a state government having jurisdiction over the employer, limiting commerce, travel, or group meetings related to COVID-19. “

“Yes, your business qualifies for the ERC with a drop in revenue if it had a significant decline in gross receipts. The meaning of a significant decline in gross receipts differs between 2020 and 2021.

In 2020, a significant decline is defined as a 50% decrease compared to the same calendar quarter in 2019.

In 2021, a significant decline is defined as a 20% decrease compared to the same calendar quarter in 2019.”

Yes. Under the Consolidated Appropriations Act (CAA), businesses can qualify for the ERC even if they already received a PPP loan. Employers are allowed to claim ERC on wages that were not paid with the proceeds of a PPP loan. It is important to note that you can’t use wages to calculate ERC that were used to qualify for PPP loan forgiveness. This is known as “double dipping” and is not permitted by the IRS.

No, unlike a loan, this credit does not have to be repaid. If audited the IRS has the right to claw back the funds.

To qualify, your business must have been negatively impacted in either of the following ways:

- A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meetings.

- Gross receipt reduction criteria is different for 2020 and 2021, but is measured against the current quarter as compared to 2019 pre-COVID amounts.

- A business can be eligible for one quarter and not another.

- Initially, under the CARES Act of 2020, businesses were not able to qualify for the ERC if they had already received a Paycheck Protection Program (PPP) loan. With new legislation in 2021, employers are now eligible for both programs.

The ERC program covers eligible wages paid to W-2 employees from March 13th, 2020 through September 30th, 2021 for eligible employers.

The employee retention credit (ERC) is a refundable payroll tax credit that was put into law through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The ERC is for businesses that continued to pay employees while shut down due to COVID -19 restrictions or had significant decline in gross receipts from March 13, 2020 to September 30, 2021. This credit offsets employment taxes paid by an employer to offer relief from the COVID-19 pandemic.

The deadline for claiming the ERC for eligible quarters in 2020 is April 15, 2024. The deadline for claiming the ERC for eligible quarters in 2021 is April 15, 2025.

The ERC will be issued in the form of a cash refund that you will receive in the mail from the IRS. The IRS will send checks based on qualifying quarters. You may receivce several checks (e.g., one check per quarter). The IRS reserves the right to use funds as a credit towards back taxes.

“Yes, you will need to refile your income tax returns. The IRS has indicated your company’s wage expense (deduction) on their income tax return must be reduced by the amount of the ERC for the applicable tax year (2020 or 2021). You will need to file an amended federal and state income tax return for the taxable year of the credit to correct any overstated wage deduction.

Note: Any interest paid to you by the IRS would have to be reported on your income tax filing.”

The IRS issued these warnings, as there are many fly-by-night, so-called ERC “experts” or “consultants” that are misrepresenting their experiences and the parameters of the ERC program to employers. The ERC is a complicated tax program that requires deep expertise and understand of the nuances. When choosing an ERC company look for companies with a proven real track record and watch out for red flags (e..g, large upfront cost, no CPAs or tax professionals on staff)

“The IRS Audit period for ERC is:

3 years for 2020 and Q1,Q2 of 2021

5 years for Q3 of 2021 “

While the timeline may vary based on the IRS workload, we are seeing clients receive refunds within a 4-10 month timeframe from filing. The timeline may vary as the IRS’s process varies.

The Employee Retention Credit (ERC) allows employers to claim a maximum credit amount of $26,000 per employee. For the tax year 2020, employers can claim up to 50% of qualified wages per employee, with a maximum credit of $5,000 per employee for the entire year. In contrast, for the tax year 2021, employers can claim up to 70% of qualified wages per employee per quarter, with a maximum credit of $21,000 per employee for the year. However, it’s worth noting that most businesses will only be eligible to claim qualified wages for Q1 through Q3 of 2021.

Unlike a loan or other form of business funding, the Employee Retention Credit (ERC) is a fully refundable tax credit that does not come with limitations on how it can be spent. As a result, businesses that qualify for the ERC can choose to spend their refund in any way they see fit.

What some of our clients say

we always take care of our clients and they love our service